Taxes Overview

In this setup area you may specify which taxes you are required to apply in your Country. While the tax settings set up here are defaults for use throughout the entire system, custom tax rates and exemptions may be applied on a per situation basis for each customer account, repair service or Quotes. All taxes are calculated after any applicable discounts have already been applied.

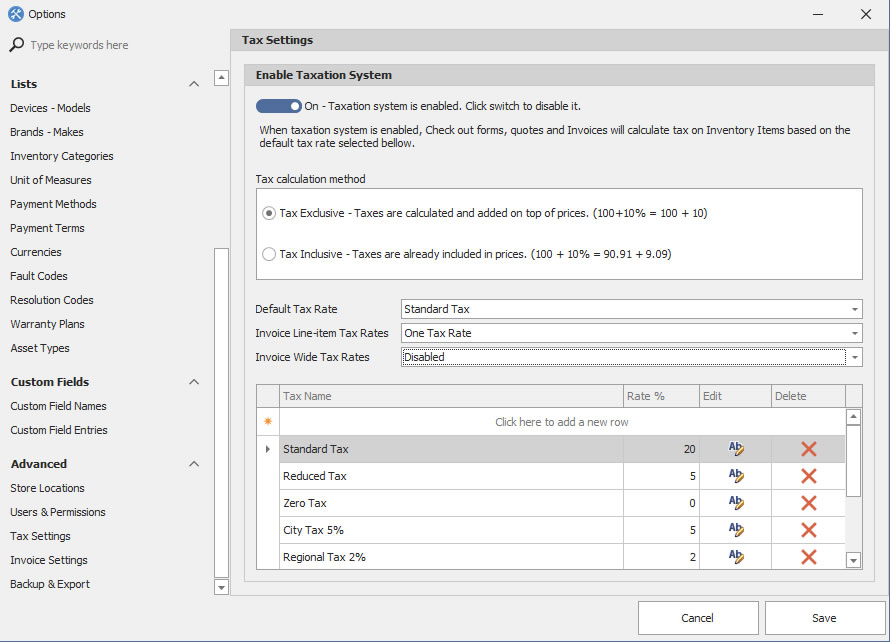

You can setup the taxes applies for your Country by going Settings ![]() Tax Settings.

Tax Settings.

If you want to Enable the taxation system so Tax is calculated on Print Forms, toggle ON the switch of Enable Taxation System section. Then insert/edit the taxation name and the rate.

Our invoicing module's tax system is highly flexible and accommodates the application of up to three different tax rates to individual product-line items on an invoice or receipt.

Moreover, the tax system enables you to select up to three distinct taxes to be applied to the subtotal of the entire invoice. For instance, some customers may prefer to utilize only one universal tax that applies to the total of all the items on the invoice. This is where Invoice-Wide Taxes come into play and prove to be beneficial.

In summary, you can have a maximum of three different taxes for each item on your invoice and up to three different taxes affecting the overall subtotal of the entire invoice. These taxes can be either exclusive or inclusive

*The following applies only to the Print Check-in and Check-out forms.

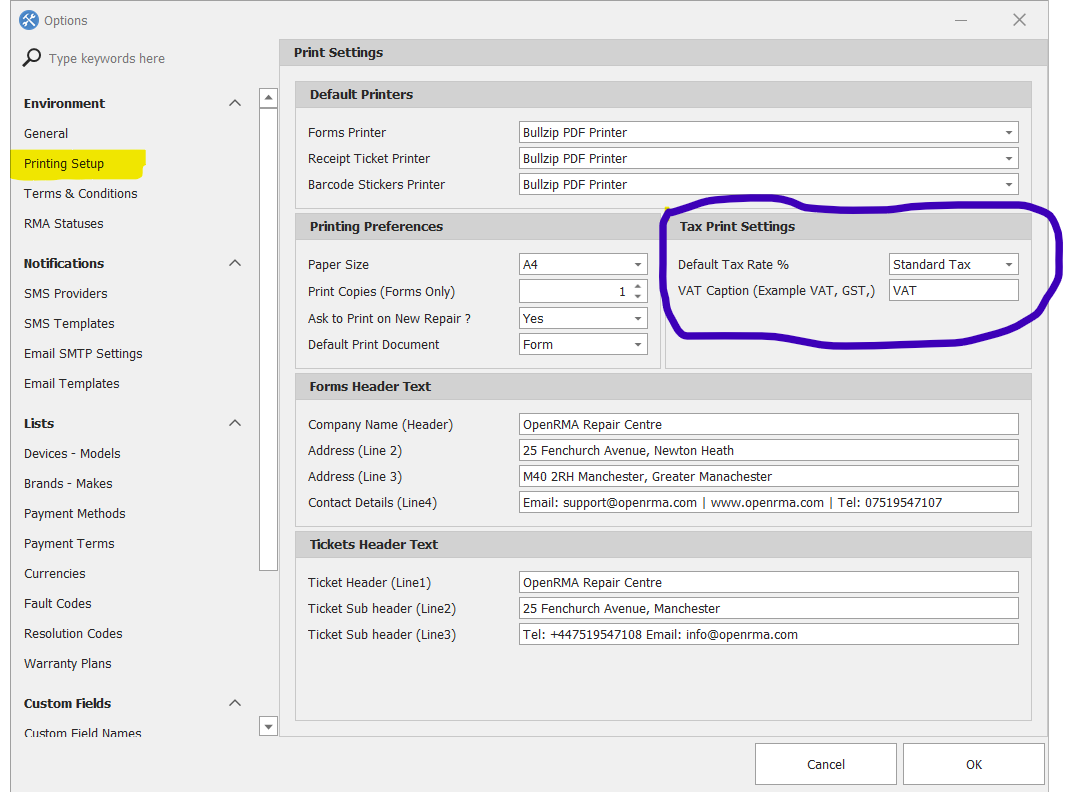

After you have insert all your taxes and rates, you need to select Which tax to calculate by default on Print Forms and what is the Tax label, for example VAT, TAX, IVA and so on..

Go to Print settings and select your default TAX and Caption as the screen shot bellow.